Update 26 February 2013 – Fortunately some stories have a happy ending and I’m pleased to report that this is one.

Just before I wrote the original article, I put in a request for a refund of lost fees. At first Paypal offered me just a quarter of the lost fees. I sent in a detailed analysis of the last two years (the information available online) as well as a rough projection for a previous year. Paypal’s merchant support were gracious enough to offer about 50% of the lost fees as compensation. While Paypal should stop doing this – blocking clients automatic access to better rates – their customer support was efficient and polite. If you made the same mistake I did of not applying for merchant rates, I recommend approaching Paypal slowly and carefully and provide them detailed documentation of your financial loss. This is very forward thinking on Paypal’s part as I’ve put a lot more money in their coffers than the relatively small sums separating us.

Why would Paypal steal from their very best clients? A bit of a mystery. You’d think they’d take better care of those of us keeping them in business.

The Usurers Marinus van Reymersuaele: senior Paypal executives eyes look much the same

while they are cooking the books in their favour.Plus ça change, plus c’est la même chose.

Since the days of the Old Temple, through hawala in the Middle Ages and to Casanova’s lettres de change, the money changers have always had their hands deep in our pockets. For a small business, operating internationally, it’s very difficult to get paid without paying close to 10% of the revenue to some intermediary or another (sometimes split like merchant and gateway fees). In this context, Paypal seems like a breath of fresh air. At 2.9% to 3.9% plus 30¢ transaction fee, your costs are about half of the other solutions.

Happily Paypal seems to have stopped regularly stealing from businesses by freezing accounts on slim grounds.

I don’t like to use them since they stole Wikileaks money (see also Cryptome incident: this time Paypal gave the money back) but we don’t have much choice as almost every Western financial institution accepted the shutdown orders from Washington (including Amazon and all the major credit cards).

So far so good. But outside of outright fraud, Paypal has another trick in their pocket, through which they are raking in millions at the expense of their best partners, mainly small businesses.

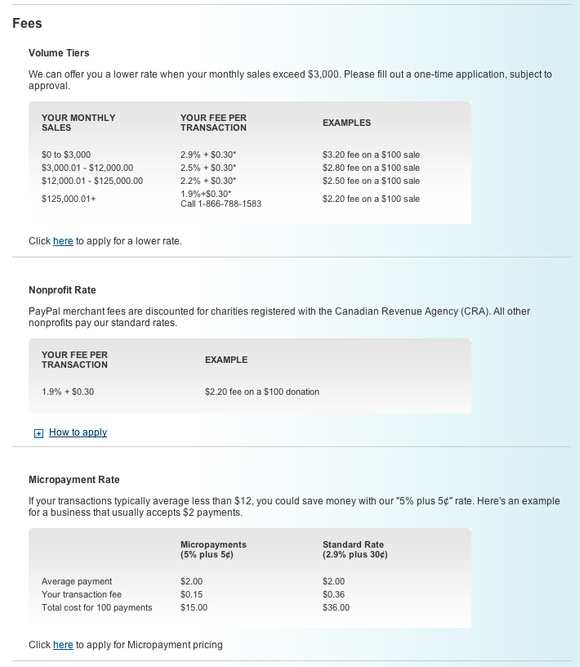

Paypal fees are on a sliding scale depending on how much business you do.

| Monthly Sales Volume | Fees |

| $0.01 – $3,000.00 | 2.9% + $0.30 CAD |

| $3,000.01 – $12,000.00 | 2.5% + $0.30 CAD |

| $12,000.01 – $125,000.00 | 2.2% + $0.30 CAD |

| Over $125,000.00 | 1.9% + $0.30 CAD |

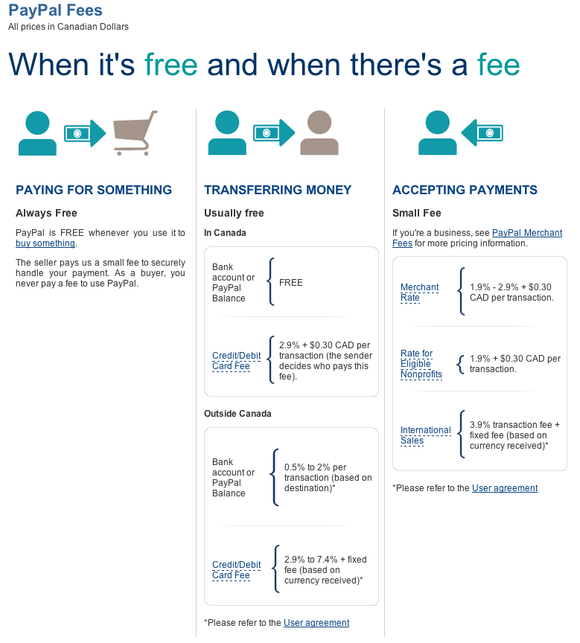

Here’s how Paypal sells clients on their services:

Paypal fees Canada: No mention here of having to apply for lower rates

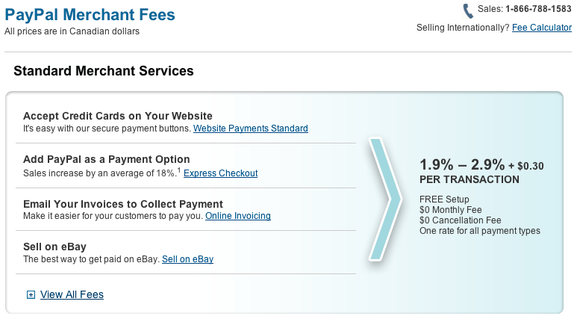

Here’s how the offer looks on Paypal’s initial merchant sales page.

Paypal merchant fees

Here’s the fine print at the bottom of that page. Still pretty clear:

Paypal volume tiers: instead of “Click here to apply for a lower rate” it should read:

“Higher rate applies in perpetuity unless you apply for a lower rate.”

Looks great. Just pump up your volume and your fees fall.

Nope, you missed the trick. It doesn’t work like that.

You can pump up the volume all you want and Paypal doesn’t change your rates. You have to ask Paypal to change your rates. In the meantime, they pocket .4% to 1% of your total sales volume.

It happened to Foliovision. Our sales volume has been third tier for about a year now. I thought Paypal had put us in the appropriate tier or that we were sliding in and out depending on the volume of international payments. No, Paypal were just keeping our money and not saying anything.

One expects this kind of duplicity from con artists and/or stock brokers. This sort of ball and cup game suits the fair grounds of a dodgy circus outside of Paris but not from a financial partner to whom one is paying fat fees every month.

I’ve spoken to a pleasant enough fellow in merchant services called Bill who has been there for twelve years. He’s put in a request to his manager to credit the stolen fees back to my account. I’ll post how it goes.

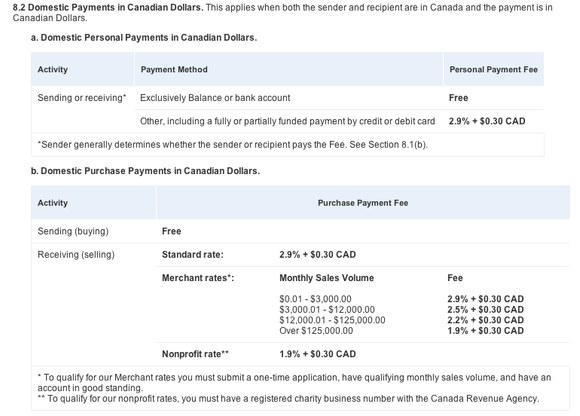

Bill’s defence is that this information is on the Paypal website. No Bill it’s not on your website, it’s hidden. Here’s where rates are buried in the user agreement (15 pages of small print):

Paypal user agreement fine print: very cute little asterisk which costs Paypal’s best clients thousands per year

If you are in our situation, make sure you apply for merchant rates as soon as you qualify. It’s not clear for me that if you apply when in the second tier if you will be boosted to third tier if you make the volume requirements.

ADDENDUM: Merchant Rates over Time and Remaining Qualified

One bit of good news: if you qualify for third tier you only need to maintain second tier volume to keep your third tier rates. I.e. if you had a month with $20,000 of sales but your normal sales volume is $4000 and you apply for merchant rates in month, it appears you keep the tier three pricing. No I’m misreading the letter:

Congratulations! You have been approved to receive PayPal’s Merchant

Rates. Effective immediately, you will be charged

2.2% + $0.30 CAD to receive payments.To keep your Merchant Rate, please keep your PayPal account in good

standing and your payment level above $3,000.00 CAD.

It’s clear that I keep a merchant rate if we meet tier two. But if we fall below $3000 in even a single month (could easily happen on our billing cycles), we’re kicked out of the program and Paypal is free to pickpocket me again when sales climb.

Alas, dealing with Paypal is like going to the market in Bucharest or Paris. Keep a firm hand on your wallet and your eyes wide open.

Alec Kinnear

Alec has been helping businesses succeed online since 2000. Alec is an SEM expert with a background in advertising, as a former Head of Television for Grey Moscow and Senior Television Producer for Bates, Saatchi and Saatchi Russia.

I totally agree with your article. I am only said about the last sentence and the comparison with Bucharest.

The thiefs and the bad persons are everywhere and even your article shows that many times the White collar thief is worse than anybody. Eg: Paypal, a billionaire company.

I kindly ask you to change the expression.

Thank you

I don’t know Dan, pickpockets do seem to be a problem in Bucharest. I’ll add Paris to the mix (although many of the pickpockets there are imported from a certain somewhere, there are enough native ones too).

About the white collar criminals I totally agree. White color criminals steal far more money and do more damage and yet go almost unpunished. There’s something deeply wrong in contemporary society which excuses the large criminals and persecutes the small ones.

I had problems with PayPal 10 years ago. Have not used them since them. Good riddance.

If your not buying something off ebay I wouldnt use PP as an Online Payment method! I actually prefer using Prepaid cards such as the Paysafecard much better – can be bought at the local gas station, store and can easily be used on sites like itunes, amazon, steam, etc no registration or verification needed! Easy does it! haha Thanks for the article!

Fortunately some stories have a happy ending and I’m pleased to report that this is one.

Just before I wrote the original article, I put in a request for a refund of lost fees. At first Paypal offered me just a quarter of the lost fees. I sent in a detailed analysis of the last two years (the information available online) as well as a rough projection for a previous year. Paypal’s merchant support were gracious enough to offer about 50% of the lost fees as compensation. While Paypal should stop doing this – blocking clients automatic access to better rates – their customer support was efficient and polite. If you made the same mistake I did of not applying for merchant rates, I recommend approaching Paypal slowly and carefully and provide them detailed documentation of your financial loss. This is very forward thinking on Paypal’s part as I’ve put a lot more money in their coffers than the relatively small sums separating us.

Do you also have to ‘apply’ if your payment level goes below $3,000.00 per month :-P

Hi Vincent,

Thanks for stopping by. Good question.

We haven’t gone below $3000, so I don’t have first hand experience, but based on the documentation, it looks like the answer is yes. If you have first hand experience, it would be great if you could share it with readers of this article.

Paypal really a dirty business. They have different rate, if you don’t know, they just earn more money. I think congress should work on this, it’s not fair at all.

I do about $17,000 a month with Ebay, “all Paypal” and needed another Paypal account in my wifes name. She called and set it up, was told she had to wait to qualify for merchant rate even though it was linked to the same high generating ebay account. They said it would roll over to the better rate in about 2 months. About a year goes buy and I finally notice that it never happened and they have been stealing from me the whole time. The first rep I spoke to was very nice and understanding, telling me that my business was way more important to them than the $700 plus they took from me and said the money should be back in my account in a couple weeks. That was 2 months ago and I have not gotten a dime. I called back 2 weeks ago and got a Parrot for a rep who did nothing but repeat policy over and over again patronizing me till I almost exploded. I am afraid that I may have to start litigation at this point but will try one more time today. If anyone is interested in a class action with a similar Paypal problem, please contact me.

Hi Mike,

I can understand your anger. I felt the same way. Fortunately “Bob” helped me out and did resolve the issue. I did take a 50% hit which was a four digit figure.

I guess you have to try again. Point Paypal to this post.

Fortunately for Paypal most of the other options are worse with 8% and 12% commissions on international transactions.

Making the web work for you, Alec

How do you go about asking for the return of over charged fees?

Hi Enlighten,

Start by submitting a customer service request and escalate it slowly. Eventually you’ll end up in the hands of someone in charge of retaining large clients.

Make sure you have good documentation. If you want to play hard ball, you could probably submit a small claims court claim and Paypal would settle rather than send a lawyer. You might have your Paypal account closed. The Paypal monopoly noose draws ever tighter. Many businesses would struggle without Paypal and Paypal fees are about one third of their closest competitors. Small business owners should be worrried.

Hi Mike & Alec,

Thank you for the article Alec – well written and I am in full agreement with everything you wrote about Paypal. I just discovered Paypal’s trickery and am now undergoing their resolution process.

Mike, what action have you taken since Oct 31, 2013? Depending on how Paypal reacts to my circumstance, I may be interested in joining a class action.

Hi Matt,

A class action would be most appropriate. It’s basically pickpocketing your best clients. I’m still pretty mad about losing my own $1000+ hard earned dollars (they kept half of my money).

These big American companies treat their clients and the world for fools. Seems to be all the vogue these days (the US government is worse).

The asterisk indicating that a merchant must apply for the discounted rates is still not found on Paypal’s rate webpage:

paypal.com/us/webapps/mpp/merchant-fees

The only requirement listed is the $30 monthly fee.

Of course, it is in the fine print of the merchant agreement, but this is a clear bait & switch. Completely misleading and unbecoming of such a large and well-known company.

But think of the money Paypal make fleecing it’s best customers, Matt. All that money unclaimed: it’s tens of millions every year. Lots of great bonuses all round.

Goldman Sachs has a word for us, not clients but muppets.

While I appreciate your article very much, one thing seems to be missing. What alternatives to PayPal are there for the small business?

Due to the PCI elephant in the room as well as the big name credit card breaches of late (Target, WooThemes, etc.) I’m phobic about allowing any credit card data pass through my or our clients’ websites. The risk is too high.

The reason I “like” PayPal is because it keeps credit card transactions off site and thus reduces, and sometimes eliminates, PCI DSS compliance requirements.

I’ve looked at but not tried 2CheckOut. They have a different set of problems such as payouts every 30 days instead of immediate, but seem to be less likely to freeze an account.

Authorize.net is pretty decent as an offsite credit card processor, but they don’t have the conveniences of PayPal.

Any suggestions are appreciated!

All the best.

Hi Mark,

That is a bit the bind: such low fees for small clients are only available at Paypal. We have a partner who uses esellerate and let it be known that long term partners get substantial discounts on the book rates of 8.9% and 5.9%. Esellerate is now part of Digital River so I wouldn’t trust them with my money or my customers. Digital River were the innovators who came up with or at least popularised the idea of a premium addon option for allowing downloads of the software you bought in the future: without it, you lose your software and license. Digital River are the worst kind of crooks and bottom feeders, making Paypal look like a coop trust.

Thanks for this post! Every time I have thoughts about opening an account with paypal, I go online and look through all the complaint articles to remember why I did not go for it in the first place. For international business, located outside the US, fees go far beyond 3.9%, as there is an additional currency conversion fee. So it is not even a cost-effective option. Also things described by you are not acceptable when talking about money. All terms and conditions should be very straight-forward and clear. Indeed, “pick-pocketing” is a good term for such actions. I prefer an alternative that is less popular, but does the business in a proper way.

this must have caused you to research a better company that you now use. Can you recommend an alternative company rather than use PayPal ?